Card Processing - The Facts

Table of ContentsHow Card Processing can Save You Time, Stress, and Money.Not known Details About Payment Solutions The Best Strategy To Use For Payment CheckupMore About Card ProcessingAll About Payment SolutionEcommerce Can Be Fun For AnyonePayment Solution Can Be Fun For AnyoneThe 10-Minute Rule for Payment Solutions5 Simple Techniques For Payment Solutions

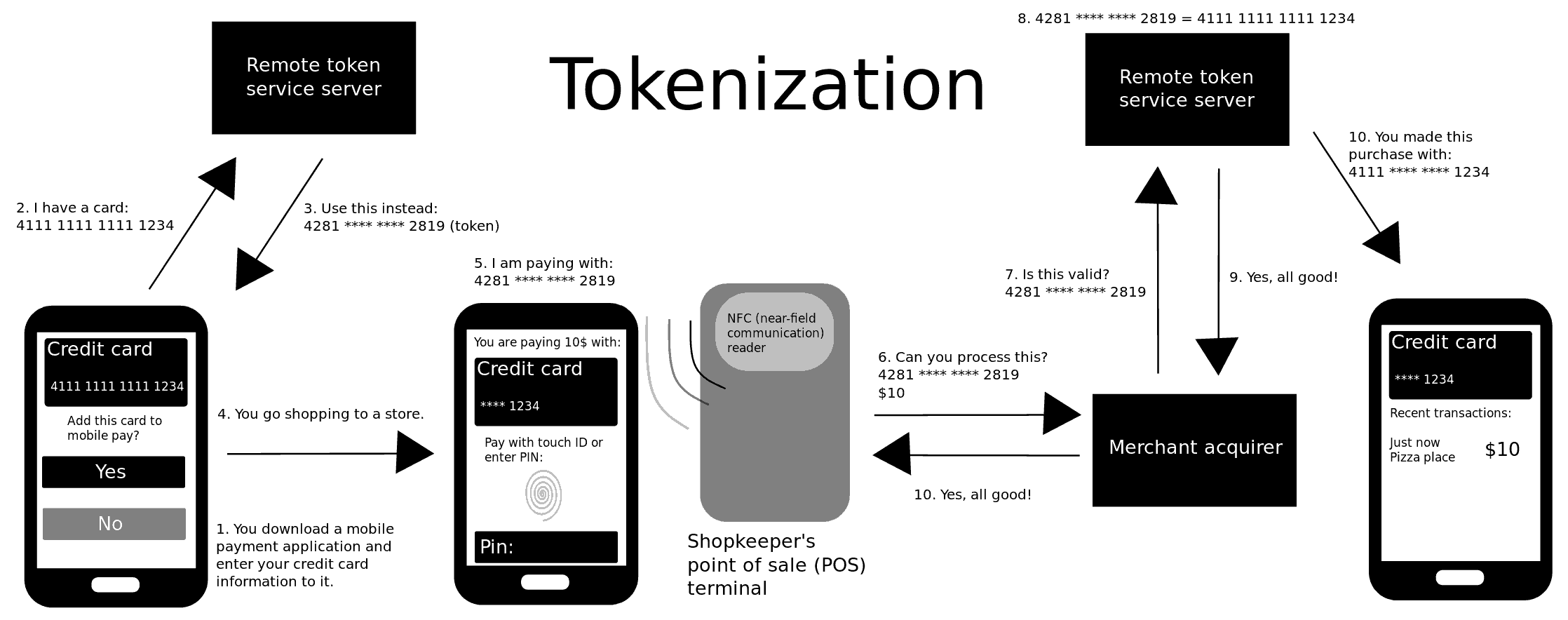

The most common grievance for a chargeback is that the cardholder can not bear in mind the purchase. The chargeback proportion is very low for deals in a face-to-face (POS) environment. See Chargeback Management.You don't require to come to be a specialist, yet you'll be a much better consumer if you know exactly how bank card handling really functions - card processing. To comprehend just how the repayment procedure jobs, we'll take a look at the actors as well as their functions. Who are the stars in a credit rating and debit card purchases? gets a credit history or debit card from an uses the account to spend for products or solutions.

See This Report on Payment Solution

That's the credit history card process in a nutshell. The charges the account for the quantity of the deals. The then transfers appropriate funds for the deals to the, minus interchange charges.

Here's where payment processing industry comes in useful. It does not matter whether you have a brick as well as mortar shop or work by means of the net just or whether you're included in the resort organization or economic services.

The Payment Solutions Statements

You can get a seller account through a payment processing business, an independent specialist, or a huge bank. Without it, you would certainly have no place to maintain the cash your clients pay you. A settlement handling firm or banks manages the purchases in between your clients' financial institutions and your financial institution. They deal with such concerns as credit rating card credibility, offered funds, card limits, and so forth.

You must permit sellers to accessibility information from the backend so they can check out history of settlements, cancellations, as well as various other transaction information. PCI Protection aids suppliers, sellers, and economic organizations carry out standards for producing safe and secure settlement options.

Some Known Details About Payment Processor

Yes, there was a time when typical card payment processing software satisfied the major requirements of little services. However things have actually altered, as well as the repayment processing software program market has expanded significantly. This suggests that you don't need to go for less innovative website repayment processing systems that aren't precisely what you need.

Various other downsides include high prices for some kinds of payment handling, limitations on the number of transactions per day and quantity per transaction, and also safety and security openings. There's also a variety of on-line repayment handling software program (i.

merchant accountsVendor sometimes with occasionally payment gatewayRepaymentPortal An additional selection is an open source payment handling system.

The Definitive Guide to Payment Processor

They can also make your cash flow more predictable, which is something that every small service owner pursues. Learn more just how around B2B settlements function, as well as which are the very best B2B repayment products for your small company. B2B repayments are repayments made between 2 sellers for goods or services.

The Definitive Guide for Card Processing

Individuals included: There are several individuals involved with each B2B transaction, consisting of receivables, accounts payable, payment, and purchase groups. Settlement hold-up: When you pay a buddy or member of the family for something, it's often appropriate on-site (e. g. at the dining establishment if you're splitting a bill) or just a few hrs after the event. Merchant Account.

In light of the intricacy of B2B settlements, more as well as extra services are deciding for trackable, electronic repayment choices. There online payment systems are five major methods to send as well as get B2B settlements: Checks This group consists of conventional paper checks and also digital checks released by a purchaser to a seller.

Payment Solutions Fundamentals Explained

Each choice varies in convenience of usage for the sender and also recipient, cost, and protection - payment solutions. That said, many businesses are changing away from paper checks and also relocating towards digital and also electronic payments.

10 Easy Facts About Ecommerce Explained

Settlements software application and applications have records that give you an introduction of your receivables and accounts payable. For instance, if there a few sellers that regularly pay you late, you can either impose more stringent deadlines or quit working with them. B2B payment solutions likewise make it much easier for your customers to pay you, aiding you get settlement faster.